keepingcurrentmatters.com | May 25, 2023

If you’re trying to decide if now’s the time to sell your house, here’s what you should know. The limited number of homes available right now gives you a big advantage. That’s because there are more buyers out there than there are homes for sale. And, with so few homes on the market, buyers will have fewer options, so you set yourself up to get the most eyes possible on your house.

Here’s what industry experts are saying about why selling now has its benefits:

“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

“We have not seen the traditional uptick in new listings from existing homeowners, so undersupply of housing will continue to heighten market competition and put pressure on prices in most regions. Some markets are already heating up considerably, but price premiums that we saw last spring and summer are unlikely.”

“Well-priced, move-in ready homes with curb appeal in desirable areas are still receiving multiple offers and selling for over the asking price in many parts of the country . . .”

“. . . sellers who price and market their home competitively shouldn’t have a problem finding a buyer.”

If you’re thinking about selling your house, connect us at CA Real Estate Group and we can share the expert insights you need to make the best possible move today. Call Christine Almarines at 714-476-4637.

June 14, 2023

From YouTube to TikTok to the backyard barbecue, there are plenty of narratives regarding the pending doom for housing that the underlying data does not support.

It’s a hot market that we’re advising all Sellers take advantage of! ACT SOON and contact us to get your home sold for a great price!

Orange County Housing Report:

Housing Insanity Returns

April 17, 2023

Copyright 2023- Steven Thomas, Reports On Housing – All Rights Reserved. This report may not be reproduced in whole or part without express written permission from the author.

Here’s everything you need to know about what’s happening in the Real Estate Market.

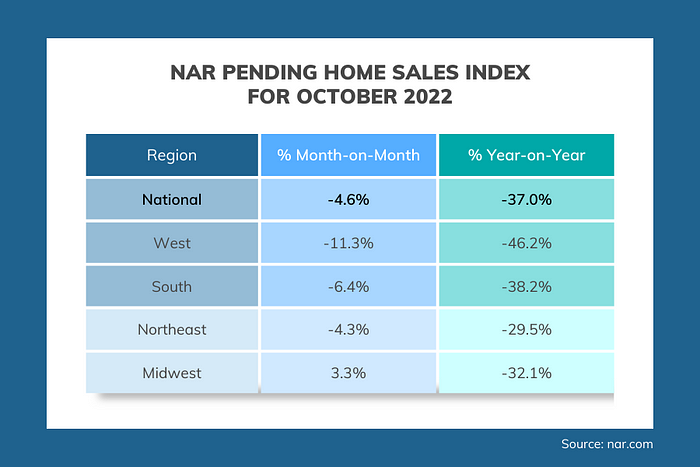

The NAR’s Pending Sales Index for October fell 4.6% in a month and 37% compared to October 2021. Pending sales in the West region were down 46%. [Source: NAR] Keep in mind that 30-yr mortgage rates were >7% for the entire month of October. They’re now around 6.3%.

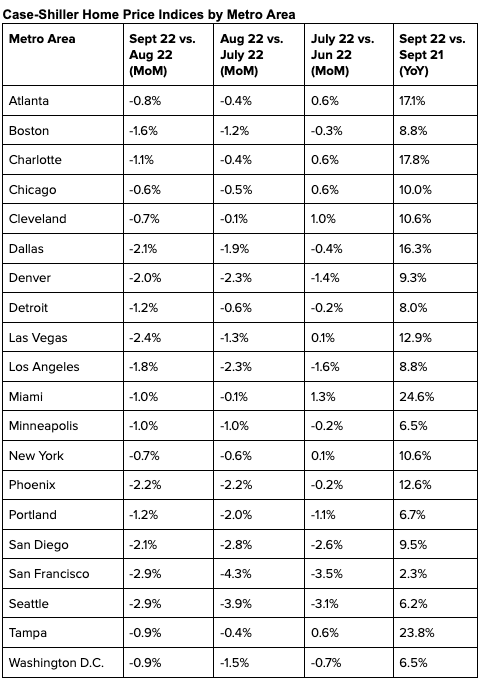

The Case-Shiller Home Price Index for September fell 1% in a month. From their peak in June, national home prices have slid ~2.5%, while prices in SFO & SEA are now down more than 10%. [Source: CoreLogic]

Fed Chair Jerome Powell said that “the time for moderating the pace of rate increases may come as soon as the December meeting” during a speech at the Brookings Institution. In other words, no more +75 bps.

The day after Powell’s comments, the PCE inflation figure for October came in at an annualized rate of 6%, better (that is to say, lower) than expectations and a further deceleration from 6.3% in September and the peak of 7% in June. [Source: BEA]

Companies added only 127k jobs in November, vs. +239k in October. This was well below Street expectations. Job losses in manufacturing & biz services dragged the total lower. [Source: ADP]

The NAHB’s Chief Economist expects a mild recession from 4Q 2022–2Q 2023, but sees mortgage rates at or below 6% by end-2023/early 2024, either because the Fed has ‘beaten’ inflation, or because the recession turns out to be bigger than expected. [Source: NAHB]

With 30-year mortgage rates above 7% for the entire month, we knew that October pending sales would be bad — and they were. The NAR’s Pending Home Sales Index (PHSI) dropped 4.6% in a month. That’s the 5th-straight monthly decline in the PHSI. Compared to October 2021, the PHSI was down 37% YoY.

The contraction was significantly worse in the West, with October pending sales dropping 11% MoM and down 46.2% YoY. That’s right, pending sales nearly halved in the West.

Pending sales are a forward indicator of existing home sales (leading by 1–2 months). So prepare yourself for some nasty November and December existing home sales figures.

But there’s a silver lining: mortgage rates are already 90–100bps (a full percentage point) lower. As NAR’s Chief Economist Lawrence Yun wrote, “October was a difficult month for buyers as they faced 20-year-high mortgage rates…[but] The upcoming months should see a return of buyers as mortgage rates appear to have already peaked and have been coming down since mid-November.”

In fact, there are signs that a recovery in activity (thanks to lower rates) is already happening. The MBA (Mortgage Bankers Association) tracks new purchase loan applications on a weekly basis. This is the fourth week in a row that applications have risen week-on-week.

For the third consecutive month, home prices declined on a month-over-month basis. The national index was down 1.0% MoM, but the 20-city index was down 1.5% MoM. Don’t be fooled by the small numbers; these are big decreases. If this happened every month, prices would be down 12–18% in a year.

As in August, prices declined in each of the 20 big cities. However, for the cities experiencing the sharpest price drops (San Francisco, Seattle, Las Vegas etc.), the magnitude of price declines actually slowed a bit in September.

Here’s how the National Association of Homebuilders’ Chief Economist, Robert Dietz, sees things:

2020–2021: Unsustainable, above-trend growth in home sales

2022–2023: Compensating below-trend growth in home sales

2024+: A return to trend growth in home sales (with >1 million in new home sales annually)

He expects a mild recession for the next three quarters, unemployment rates rising to near 6% (from 3% today) in 2024 and national home prices falling ~10%. At the same time, his message was essentially optimistic — lower inflation, interest rates and home prices will bring buyers (and builders) back relatively quickly.

A few anecdotes I found interesting:

Note: In any given year, existing home sales are 7–15 times higher than new home sales. This isn’t because builders are lazy. It’s because there are around 145 million existing housing units. Even if builders were able to construct 2 million homes a year (something they’ve never achieved before), that would only raise the total housing stock by 1.3%.

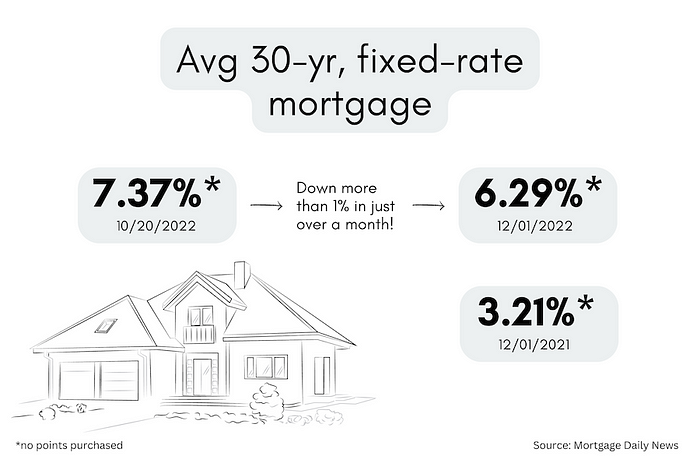

After months of extreme volatility, 30-yr mortgage rates had flatlined at 6.6% for several weeks. But with another good (well, improving) inflation figure, and Powell sounding a bit less hawkish, the bond market was in party mode yesterday, rising 70–80 basis points.

Higher mortgage bond prices = lower mortgage bond yields = lower mortgage rates. Yesterday, the 30-yr mortgage rates moved sharply lower to 6.3% — that’s a full percentage point lower than the peak of 7.37% on October 20!

“When home prices decline, it’s pretty rare for there to not be a recession.” — NAHB Chief Economist Robert Dietz

“To anyone with a sense of history, the home boom must be a source of wonder. Housing usually leads the economy into a recession. Mortgage rates rise, then housing construction and home sales fall.” — Robert J. Samuelson in a 2002 Newsweek article

There are many different approaches to measure ‘affordability.’ But they all depend on three factors: 1) household income, 2) home prices, and 3) mortgage rates.

Right now, all three factors are moving in buyers’ favor:

Plus, there are more homes available, and less competition than last year, and sellers are more willing to negotiate on things like repairs, covering some closing costs, paying for points etc.

The key is to stay in regular contact with CA Real Estate Group. Your agent will let you know about price cuts, point out stale listings, and will keep you informed about mortgage rates. Also, waiting for the ‘perfect’ moment could be counterproductive. When (if!) conditions look perfect, they’ll look perfect to everybody else too.

For Wednesday, Nov 23

![]() To keep the holiday dinner conversations peaceful, instead of talking politics and religion, talk about REAL ESTATE! Here are your talking points. (Although it could easily lead back to the aforementioned subjects so beware.)

To keep the holiday dinner conversations peaceful, instead of talking politics and religion, talk about REAL ESTATE! Here are your talking points. (Although it could easily lead back to the aforementioned subjects so beware.) ![]()

Much higher mortgage rates have ensured that this will be the coldest 4Q in quite some time — at least as far as existing home sales go.

According to the NAR, October existing home sales fell 5.9% month-on-month (compared to September 2022) and plunged 28.4% year-on-year (compared to October 2021). This is the 9th-consecutive monthly drop. This is much more than just a seasonal slowdown.

Note: The 4.43 million figure you see in the chart below is a seasonally-adjusted, annualized figure. 4.43 million homes were not sold in October. Instead, it’s telling you that if the pace of sales seen in October (adjusted for seasonality) continued for the next 12 months, you’d sell 4.33 million homes. This figure is just 10% above the May 2020 low of 4.07 million.

In addition, there continues to be a big difference from region to region. Things were much worse in the West, where existing home sales were down 38% YoY and there was a dramatic contraction (41%-45%) in the sale of higher-end homes. On the other hand, the Northeast is performing the best (smallest contraction of 23% YoY). Also note that the big decline in homes priced between $100–250K across the US is at least partially due to fewer homes listed within that price range thanks to rapid home price increases.

After the big decline two weeks ago, average 30-year mortgage rates have hovered around the 6.6% level. This means that monthly mortgage payments are $100–200/month lower than they would have been in mid-November when rates were at 7.25% (with no points purchased).

Keeping Current Matters | Mar 8, 2022

If you’re thinking about buying or selling a home, you’ll want to keep a pulse on what’s happening with mortgage rates. Rates have been climbing in recent months, especially since January of this year. And just a few weeks ago, the 30-year fixed mortgage rate from Freddie Mac approached 4% for the first time since May of 2019. But that climb has dropped slightly over the past few weeks (see graph below):

The recent decline in mortgage rates is primarily due to growing uncertainty around geopolitical tensions surrounding Russia and Ukraine. But experts say it’s to be expected.

Odeta Kushi, Deputy Chief Economist at First American, says:

“While mortgage rates trended upward in 2022, one unintended side effect of global uncertainty is that it often results in downward pressure on mortgage rates.”

In another interview, Kushi adds:

“Geopolitical events play an important role in impacting the long end of the yield curve and mortgage rates. For example, in the weeks following the ‘Brexit’ vote in 2016, the U.S. Treasury bond yield declined and led to a corresponding decline in mortgage rates.”

Kushi’s insights are a reminder that, historically, economic uncertainty can impact the 10-year treasury yield – which has a long-standing relationship with mortgage rates and is often considered a leading indicator of where rates are headed. Basically, events overseas can have an impact on mortgage rates here, and that’s what we’re seeing today.

While no one has a crystal ball to predict exactly what will happen with rates in the future, experts agree this slight decline is temporary. Sam Khater, Chief Economist at Freddie Mac, echoes Kushi’s sentiment, but adds that the decline in rates won’t last:

“Geopolitical tensions caused U.S. Treasury yields to recede this week . . . leading to a drop in mortgage rates. While inflationary pressures remain, the cascading impacts of the war in Ukraine have created market uncertainty. Consequently, rates are expected to stay low in the short-term but will likely increase in the coming months.”

Rates will likely fluctuate in the short-term based on what’s happening globally. But before long, experts project rates will renew their climb. If you’re in the market to buy a home, doing so before rates start to rise again may be your most affordable option.

Mortgage rates are an important piece of the puzzle because they help determine how much you’ll owe on your monthly mortgage payment in your next home. Let’s connect so you have up-to-date information on rates and trusted advice on how to time your next move.

💡 Find out if we’re the right Realtor Team for you! We’re active in our community…check out @carealestategroup and call 714-476-4637!

👩 Christine Almarines @christine_almarines

Realtor DRE # 01412944

714-476-4637 | christine@carealestategroup.com

👩 Michelle Kim @michellejeankim_homes

Realtor DRE # 01885912

714-253-7531 | michelle@carealestategroup.com

CA Real Estate Group is powered by Keller Williams Realty

HOUSING MARKET UPDATE

LOS ANGELES | FEBRUARY 2021

⬇️ With inventory of active listings down by 26% this past February compared to last year February, it created a low inventory market with high buyer demand.

⬆️ This is reflected in the increase in median sales by 18.1%. Real Estate still stands to be one of the best investments available today.

? If you’ve been thinking about selling, now is a great time. If you’ve been thinking about buying, understand that it is a difficult market right now. Buyers have to be prepared to make a winning offer. However, each buyer, seller circumstance, and property will require a unique strategy.

? Whether you plan to make a move very soon or several years from now, talk to @carealestategroup to create a step-by-step plan on how to reach your goals.

? Contact us today!

Christine Almarines

Realtor | DRE # 01412944

CA Real Estate Group | Keller Williams Realty

714-476-4637 | christine@carealestategroup.com

??️??️??️??️

HOUSING MARKET UPDATE

ORANGE COUNTY | FEBRUARY 2021

⬇️ With inventory of active listings down by nearly 32% this past February compared to last year February, it created a low inventory market with high buyer demand.

⬆️ This is reflected in the increase in median sales by 9.2%. Real Estate still stands to be one of the best investments available today.

? If you’ve been thinking about selling, now is a great time. If you’ve been thinking about buying, understand that it is a difficult market right now. Buyers have to be prepared to make a winning offer. However, each buyer, seller circumstance, and property will require a unique strategy.

? Whether you plan to make a move very soon or several years from now, talk to @carealestategroup to create a step-by-step plan on how to reach your goals.

? Contact us today!

Christine Almarines

Realtor | DRE # 01412944

CA Real Estate Group | Keller Williams Realty

714-476-4637 | christine@carealestategroup.com